Collections

Recovering unpaid debts requires a strategic approach that balances cost-effectiveness with results. At Andromeda Law, we’ve developed streamlined processes to help businesses and individuals recover what they’re owed efficiently.

-

We handle collections matters through a systematic process designed to maximize recovery while minimizing costs:

1. Initial Assessment

Review of debt documentation

Validation of limitation periods

Debtor locating services when needed

Strategic planning based on debt amount and circumstances

2. Pre-Litigation Collections

Professional demand letters

Structured negotiation attempts

Payment plan arrangements

Documentation of all collection attempts

3. Legal Proceedings

Small Claims Court (Debts up to $35,000)

Streamlined filing process

Default judgment applications where appropriate

Settlement conference representation

Trial representation if necessary

Superior Court (Debts over $35,000)

Statement of Claim preparation

Motion for summary judgment when applicable

Full litigation services

Settlement negotiation

4. Judgment Enforcement

Examination in aid of execution

Wage garnishment

Bank account garnishment

Writ of seizure and sale

-

We offer flexible fee arrangements based on your specific situation:

Small Claims Collections

Fixed fee structure for straightforward matters

Percentage-based fees for certain cases

Clear cost breakdowns at each stage

Superior Court Collections

Hourly rates for complex matters

Potential contingency arrangements for suitable cases

Strategic approach to minimize costs

-

Efficient Processes

Digital documentation systems

Online payment arrangements

Virtual client meetings

Technology Integration

Electronic document signing

Virtual court appearances when available

Digital record keeping

Experience-Based Approach

Proven collection strategies

Understanding of debtor behaviors

Knowledge of enforcement options

Strategic settlement negotiations

-

We assist with:

Business-to-business debt recovery

Professional service fee collection

Rent and lease payment recovery

Contract payment defaults

Judgment enforcement

-

The collections process begins with a thorough review of your situation. Schedule a consultation to:

Evaluate your collection matter

Discuss available strategies

Review cost-effective options

Develop an action plan

Book an appointment.

The first step to starting a collections matter with Andromeda Law is to book a free consultation with Benjamin Waterman, where you will discuss your matter, the costs, and help you decide whether you want to retain Andromeda Law, and what fee structures would be most appropriate.

Please note that legal advice will not be given in the free consultation or in reply to a form submission, only once you have decided to retain Andromeda Law for your matter.

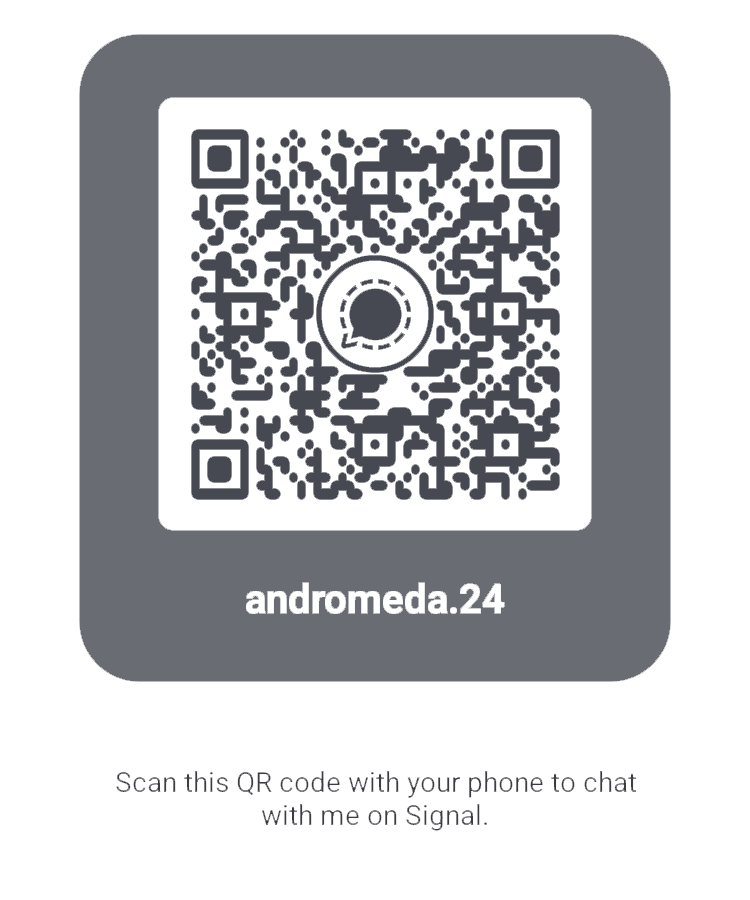

If the times listed do not work for you, rush service is required, or you have any questions for Benjamin prior to the appointment, feel free to ask them using the form below, by email to info@andromeda.law, or by text message or Signal message to (548) 776-0070.

Signal is a free, secure messaging app for confidential communication. Download it at signal.org or from your app store of choice.

Contact Benjamin

If you have any questions about the services offered by Benjamin at Andromeda Law, feel free to submit them here, or email them to info@andromeda.law.